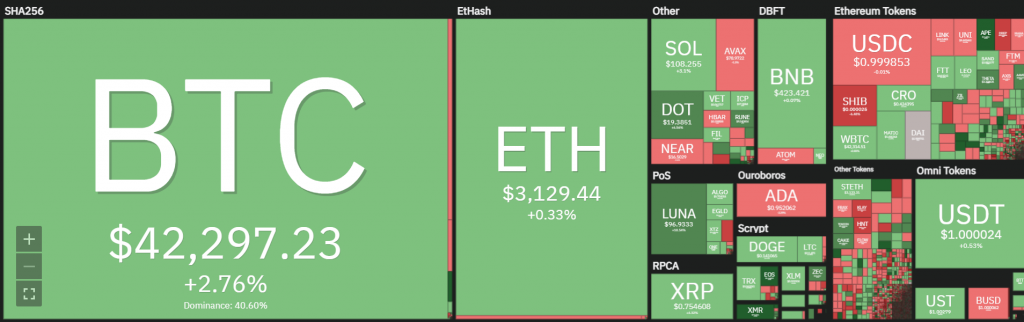

The attached overview from Coin360 shows the performance of the crypto market over the past seven days. The total crypto market cap remained fairly stable consolidating around $2,000 billion over the past week.

Bitcoin’s market dominance also did not move from its place with a percentage of 40. Ethereum’s (ETH) market dominance also remained stable at 19%. The market cap of the number 2 coin increased slightly to $376 billion.

Market cap consolidates around $2,000 billion

The attached chart shows the sideways movement of the total market cap of the cryptos. For ages this value has been hovering around $2,000 billion.

It seems to be a lull before the proverbial storm. The market is clearly awaiting a new direction, although a higher bottom was formed in early January compared to last July.

After reaching a peak of $3,000 billion in November, the crypto market has corrected significantly towards a whopping $1,500 billion which is thus a halving.

Nevertheless, the crypto market is still booming, despite or rather thanks to the high volatility: more volatility means more risks but also more opportunities.

The total market cap of cryptos reached an all time high last year with bitcoin reaching an all time high of $69,000. Meanwhile, bitcoin is now quoting $42,000.

The rise of DeFi (Decentralized Finance), Metaverse and NFTs has also boosted the crypto market in recent years. According to DeFi-Pulse, Total Value Locked is currently $90 billion. This means that we are not talking about peanuts.

Today (Thursday, April 21, ed.) Jan Robert from CryptoAcademy.co.uk is attending the FOW Trading Event in Amsterdam to lead a panel discussion. In doing so, the panelists, consisting of Flow Traders, Compass Partners and Kaiko, will share their insights on the future of DeFi and the impact the proposed legal framework will have on the market.

The European Union’s proposed Markets in Crypto Assets (MiCA) framework would drastically simplify how crypto companies can expand through the 27-nation block with a single financial passport.

The panel will also discuss whether DeFi is an alternative to traditional financial infrastructure or will it eventually be integrated into and alongside traditional financial institutions?

This will include a discussion of the significant disruptions caused by DeFi in traditional financial markets.

The turnout of mainly professional parties at the Okura hotel in Amsterdam is significant, which is a positive sign. Whether these (traditional) parties will also plunge into the crypto market en masse remains to be seen. Nevertheless, the panel discussion has put crypto (again) on the Dutch map.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.