In this column I reach for a short trade in the EUR/NZD, where the New Zealand dollar is also referred to as kiwi. The EUR/NZD has been under pressure for some time and is currently stabilizing between 1.55 and 1.60. This consolidation is not yet a guarantee for a strong recovery move. In fact, the trend I expects a further decline, with an acceleration once the low of 1.56 reached at the beginning of this year is broken.

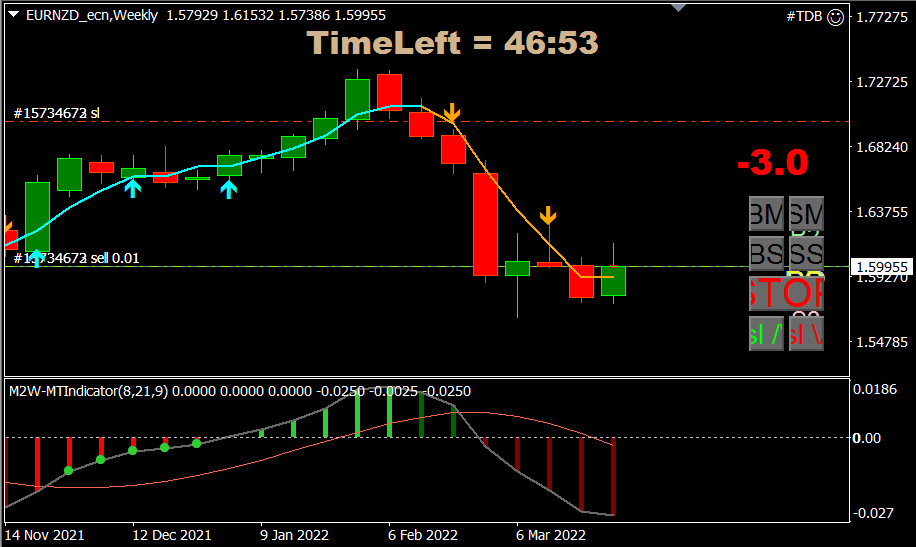

EUR/NZD weekly chart

The weekly chart shows the sharp downward trend that started in early February. The orange pma line (a custom-made average line) in the chart indicates the downward trend by means of its orange color. This indicator was generated by the M2W-TSSytem. The way is in principle clear for a further decline to (far) below 1.50.

I have therefore taken 2 short positions. Around the current price of 1.5995 I still see sufficient downward potential towards 1.45.

With a stop-loss around the level of 1.67 and a target of at least 1.45 and with a current price, the Reward/Risk ratio is around 2.14, which seems to me a great starting position. I have therefore put my money where my mouth is and opened a position of 2 times 0.01 EUR/NZD.

Below is the screenshot of my 2 times 0.01 lotsize position.

Do you also want to swing currencies intraday back and forth? This is perfectly possible by using the Money2Work-TradingSupportSystem (M2W-TSS) running on MT4. If you want to know more about the trading system, feel free to schedule a coachingscall with us with a (short) demonstration of the system: https://forms.gle/d1BFUZcSrcozCMg37

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.