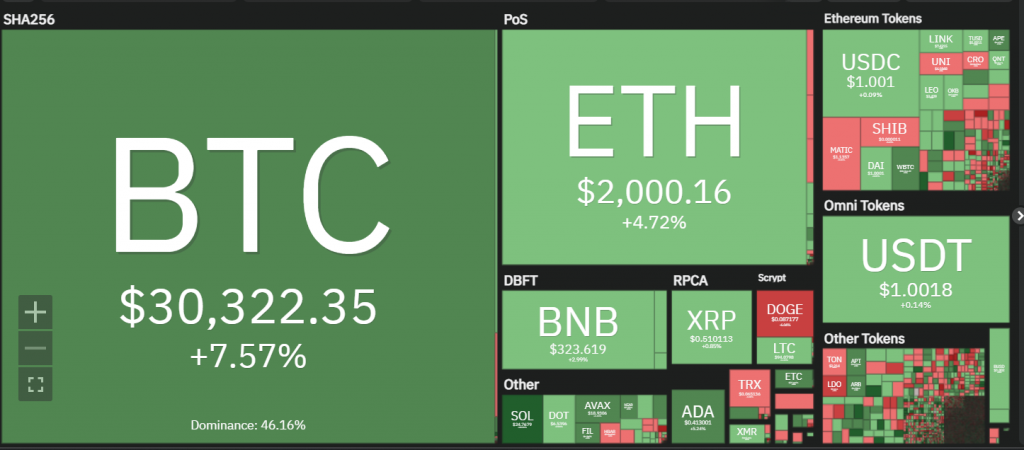

The attached overview from Coin360 illustrates the development of the crypto market over the past 7 days. According to coinmarketcap.com, the total crypto market cap is currently $1,250 billion and now counts 23,370 crypto currencies and that number continues to rise.

Bitcoin’s market dominance has risen slightly to 46% over the past week, while Bitcoin’s market cap has increased to $580 billion. Ethereum’s (ETH) market dominance has remained steady at 19.3%, while the number two coin’s market cap has increased slightly to $240 billion.

Bitcoin breaks $30,000 barrier

Bitcoin finally managed to cross the $30,000 mark once again after almost 1 year, and in a positive sense. However, the volumes leading up to the upside breakout were higher than the volumes at the breakout, which in itself is not a strong sign. It would be nicer if volumes had also picked up. High volumes mean more investor interest.

Bitcoin and Ethereum continue to be a bit of a “pivot”: last time Ethereum rose sharply ahead of the “Shanghai Upgrade” and in recent days Bitcoin just took the lead again. Together, Bitcoin and Ethereum make up 65.3% of the total crypto market. In other words, the remaining 34.7% is shared by 23,368 other altcoins. In short, there is still much work to be done by projects that issued these altcoins to (re)gain investor confidence.

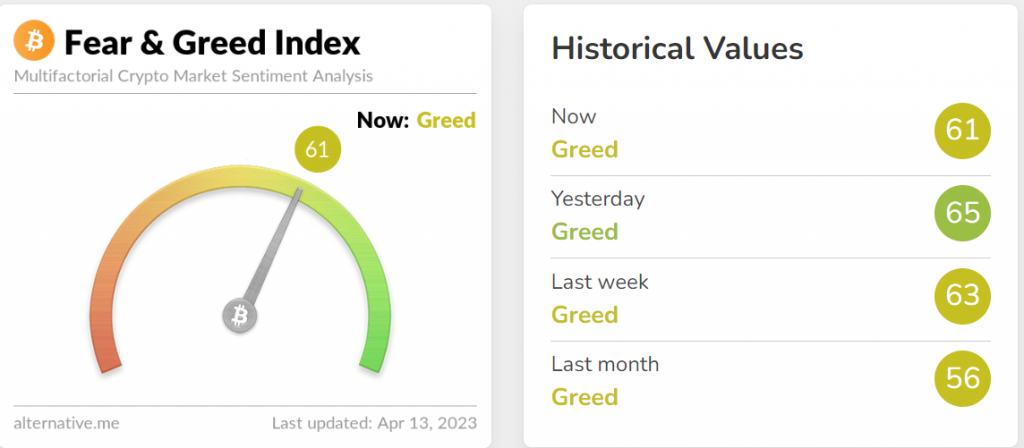

Fear & Greed Index consolidates in Greed zone

The value of the Fear & Greed Index, compiled by Alternative.me, currently stands at 61 while last week it recorded a value of 63. The index, which measures investor confidence in Bitcoin and a number of other major coins, is consolidating in the Greed zone.

Investor confidence in the crypto market is still optimistic, although for now BTC and ETH are pulling the strings. There is no overall strong positivism as yet.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.