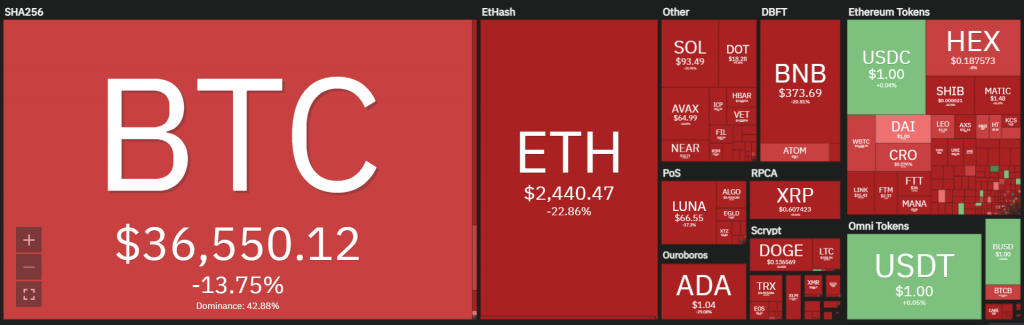

The overview below from Coin360 shows the performance of the crypto market over the past 7 days. The total crypto market cap has been hammered over the past 7 days and currently hoveres around approximately $1,600 billion. Bitcoin plunged also towards the $33,000 level, not seen since July 2021.

Now the BTC price is hovering around $36,500. In the meantime, Bitcoin’s market dominance rebounded from below 40% and is sitting now at 43%. Number 2 Ethereum (ETH), also took a hit and saw its market cap fall severely to $290 billion. Ethereum’s market dominance eroded even further to 17.6%.

Bitcoin dominance rebounds from 40% support level

The accompanying chart illustrates the market dominance of Bitcoin (BTC) since 2017. At the beginning of 2017, Bitcoin dominance was recording close to 100%. This in itself is no surprise, as at the time there were only a few thousand different coins on the market with a very small market cap. The number of crypto currencies has now risen above 17,000 so the swill has become considerably thinner.

Nevertheless, Bitcoin still has a large share of the crypto pie, namely 43%. Add to that Ethereum’s share ad 18% and then these 2 main coins only hold 61% of the market.

This means that the remaining 16,998+ coins get to share the remaining $816 billion. Of course, this amount is not evenly distributed among these coins and the market cap of coins listed around position 25 is about $10 billion.

After BTC ($820 billion) and ETH ($388 billion), Tether USDT ($78 billion), Binance Coin (BNB) ($78 billion), Cardano (ADA) ($47 billion) complete the top 5 of the crypto market. So you can see that the market cap of BTC and ETH are by far the largest, followed by the above 3 coins with a street length distance.

From this we can conclude that you should at least have BTC and ETH in your portfolio, if you want to follow the crypto market well in terms of exposure. If you want to achieve a higher beta or rather, more alpha (a higher or additional return), then it is certainly necessary to include some other altcoins in your portfolio. The advantage is: there is plenty of choice, namely about 17,000 coins. The disadvantage is, how do you find the right needle in the huge crypto mountain? That’s what our crypto services are for, to help you make a nice return.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.