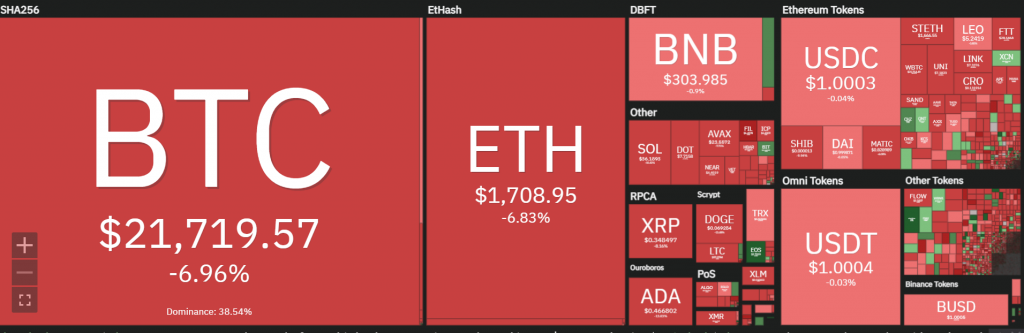

The attached overview from Coin360 illustrates the development of the crypto market over the past 7 days. The total crypto market cap decreased slightly over the past 7 days and currently stands at $1,048 billion. Bitcoin’s market dominance has recently continued to fall below 40% and is currently consolidating around this level.

Bitcoin’s market cap declined slightly towards $415 billion. Ethereum’s (ETH) market dominance remained at 20%, while Ethereum’s market cap declined slightly to $208 billion.

Bitcoin dominance declines further

While Bitcoin’s dominance was still well above 70% at the beginning of 2021, within six months this value has fallen towards 40%. Barring a spike to 48% in May this year, Bitcoin’s market share continues to hover around 40%.

Ethereum, on the other hand, saw its market share rise to around 20%. This means that both of the largest crypto currencies together hold 60% of the market. The remaining 40% – a whopping $400 billion – is thus divided between 20,724 coins (according to the count on Coinmarketcap).

It’s going to be tense whether Ethereum will mount another assault towards $2,000 ahead of the upcoming migration from the Proof-of-Work consensus model to Proof-of-Stake. From its low in June, the price has already more than doubled though, and the question is whether this event has already been factored into the price.

The crypto market needs positive momentum given the months of consolidation around $1,000 billion. Last year’s top ad $3,000 billion is still miles away.

This week the Fed’s annual “Jackson Hole” conference takes place. Investors have concerns that the plunge in cryptos could continue if the Fed makes continued ‘hawkish’ comments regarding interest rate policy.

‘Conventional’ equity investors are also holding their breath. The fear is that the economy will fall into recession if the Fed steps on the interest rate brake too hard. Whether this fear is justified, practice will show.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.