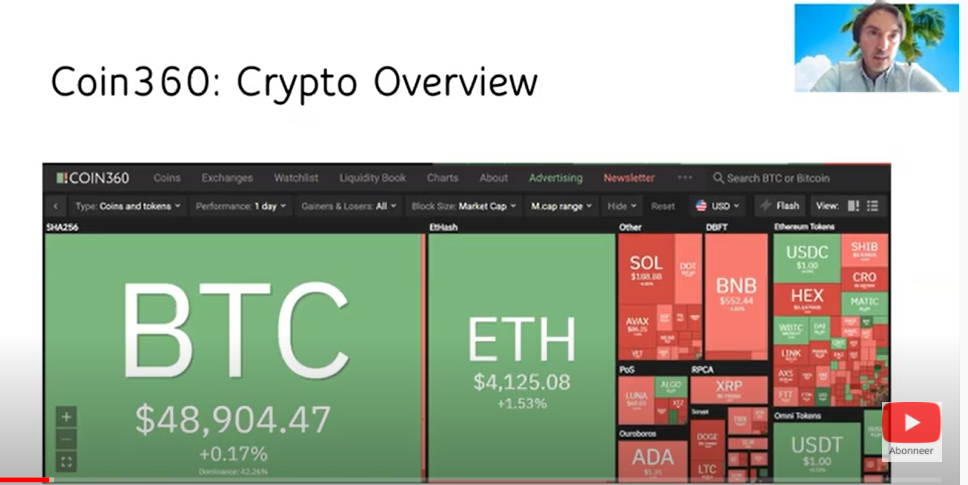

The attached overview from Coin360 illustrates the crypto market’s market shifts and market ratios over the past 7 days. The total crypto market cap took hard hits, dropping to $2,294 billion. In the process, the Bitcoin price dropped sharply to below $50,000, even touching $40,000.

Risk-off was the common thread: due to the Fed stepping on the Quantitative Easing brake and also the Covid19 variant Omicron rearing its head, investors ran for the exit, selling cryptos as well. In the process, however, Bitcoin’s market dominance remained well down at 41%. The market cap of #2 Ethereum (ETH) dropped to $501.5 billion, with Ethereum’s market dominance rising further to 21.8%.

Ethereum outperforms BTC

We still see more prospects for Ethereum than Bitcoin and mainly because of Ethereum’s better use case. Bitcoin is seen more as a store of value and digital gold. Ethereum is mainly benefiting from increasing activity in the DeFi-space, NFTs and Gaming.

The attached chart shows the ETH/BTC ratio, or the strength Ethereum versus Bitcoin. When the chart goes up, ETH outperforms Bitcoin and vice versa.

We have previously noted that Ethereum has been above 20% in terms of market dominance for quite some time. This shows the strength of Ethereum. The ETH/BTC ratio is quoting around 0.09 which is 4.5 times higher than at the beginning of this year.

Without wanting to get hung up on a prediction, we will not be surprised if the ETH/BTC ratio continues to rise towards 0.10 or even 0.12.

This means that we therefore expect Bitcoin to underperform Ethereum in the coming period. Whether that will happen, of course, remains to be seen. We therefore took advantage of the crypto-crash last week by buying Ethereum in addition to Bitcoin and a number of other coins for the X10 Crypto Challenge.

X10 Crypto Portfolio: 1,710.34 euros (+20.12%)

Finally, we report the result of our X10 Crypto Portfolio. This X10 Crypto Challenge is suitable for the speculative investor who wants to take advantage of the opportunities that the crypto market offers. There are periods of highs and lows and you have to be able to handle that. Cryptos are volatile and this service is therefore not for everyone, but 1 thing is certain: Cryptos are here to stay….

Since the start on February 25, 2021, we are at a result based on 1,710.34 euros (+20.12%) the basic invested amount of 8,500 euros. We still have 1,500 Euros ‘in reserve’ to put in as yet. If you also want to get involved in the Crypto X10 Challenge, click here for more info…

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.