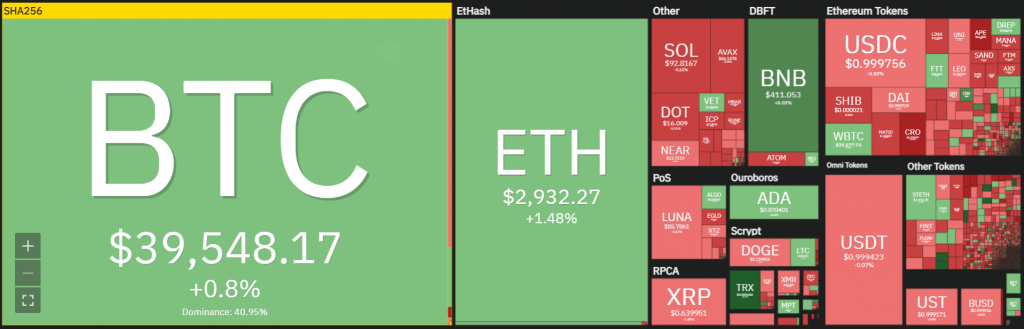

The attached overview of Coin360 shows the performance of the crypto market over the past seven days. The total crypto market cap fell slightly towards $1,700 billion last week. Bitcoin’s market dominance showed a slight increase towards 41%. Bitcoin’s market cap dropped to $704 billion. The market dominance of Ethereum (ETH) remained stable at around 20%, while the market cap of the number 2 coin fell to $331 billion.

Crypto market under the spell of the Fed

This week was dominated by the FOMC, in which Fed Chair Jerome Powell indicated that he would raise interest rates by 0.5%. In addition, plans were also put on the table to reduce the heavily inflated $9,000 billion balance sheet. All this to curb the raging inflation. This represents the most aggressive rate hike in several decades. Inflation has now reached its highest level in 40 years.

The financial markets finally reacted with relief on Wednesday evening that there was a clear cut and that an interest rate hike of 75 basis points, but there was very little left of the euphoria a day later: in other words, a significant crypto hangover was the result.

Stock markets fell sharply on Thursday, dragging crypto markets along during the afternoon. On balance, the crypto market has made little progress in the past week, because the recovery that was over the course of the week was handed over again on Thursday.

It is important that the market remains above the support level at the beginning of this year. That means Bitcoin should not dip below $33,000 and the total market cap should not fall below $1,500 billion. If that does happen, the picture for cryptos will look less rosy.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.