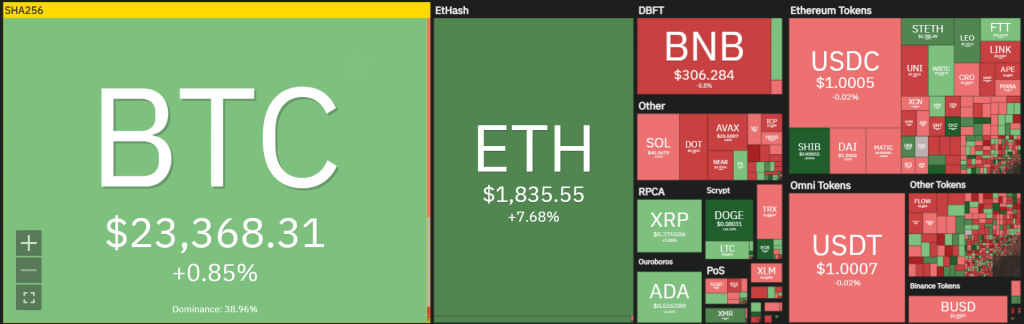

The attached overview from Coin360 illustrates the development of the crypto market in the past 7 days: after rising sharply in the previous weeks, the crypto market once again relaxed a bit in the past week. The total crypto market cap currently stands at $1,100 billion. Bitcoin’s market dominance consolidated just below 40%. Bitcoin’s market cap remained at $447 billion. Ethereum’s (ETH) market dominance consolidated around 20%, with Ethereum’s market cap reaching $224 billion.

After the crypto market rebounded from its low point in June led by BTC and ETH, the market has now taken a breather. Total crypto market cap currently stands at $1,100 billion and has now reached an important zone that was also important last June and July.

Currently, the market is quoting just below this level, so we can sincerely speak of a “bear on the road. If this bear – which amounts to $1,200 billion – is felled, we can cautiously look upwards again.

ECB bureaucrats take Crypto markets in their stride

ECB bureaucrats in Frankfurt have also woken up once again. The European Central Bank issued a statement on Wednesday through its banking supervision department that it would “take steps to regulate digital assets, given that ‘national frameworks for crypto assets vary quite widely.

In the ECB’s view, there are seemingly different approaches to harmonization following the passage of the Markets in Crypto Assets, or MiCA, and the Basel Committee on Banking Supervision that would issue guidelines for banks’ exposure to crypto.

The ECB said it would apply criteria from the Capital Requirements Directive – in effect since 2013 – to assess license applications for crypto-related activities and services.

In itself, there is not much new under the sun and it seems that in addition to pumping billions of euros into the market, the European Central Bank is looking for even more job creation for itself.

As a side note, there is already a proposal from The European Commission on the table since September 2020 for a regulation on crypto asset markets (MiCA). Initially this directive was to come into force in 2023, which has now been pushed forward to 2024 at the earliest.

In short, the above institutions have elevated bureaucracy to an art. Whether this will benefit innovation in cryptos remains to be seen. We fear not.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.