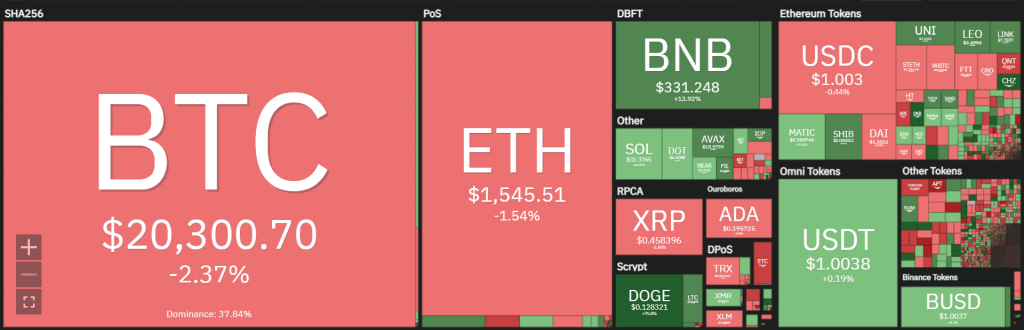

The attached overview from Coin360 illustrates the development of the crypto market over the past 7 days. The total crypto market cap is currently $1,000 billion and now numbers more than 21,600 coins.

Bitcoin’s market dominance fell slightly to 37.8%. Bitcoin’s market cap fell slightly to 389 billion over the past week. Ethereum’s (ETH) market dominance remained steady at 19%, while the No. 2 coin’s market cap fell slightly to $189 billion.

Fidelity offers retail investors commission-free trading in BTC and ETH

The Crypto branch of US investment company Fidelity will initially focus on Bitcoin and Ether. In doing so, the brokerage arm will only make money through a 1% spread per trade and thus not through fixed or variable transaction fees. Fidelity is an American multinational Financial Services company and has Assets Under Management of no less than $4,500 billion. Fidelity has also been a big supporter of Bitcoin and other crypto currencies for some time, recently even stating, “Bitcoin is a superior form of money.”

Previously, Fidelity Digital has expanded institutional offerings during the bear market, having only recently launched Ether custody and trading services for its high net worth clients.

In April this year, the U.S. asset manager even announced plans to allow retirement savers to invest directly in Bitcoin through their 401(k) accounts.

In short, even though the crypto market is not exactly strong yet, Fidelity’s move into crypto shows that major players are indeed active and increasingly actively investing in crypto or crypto-related services.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.