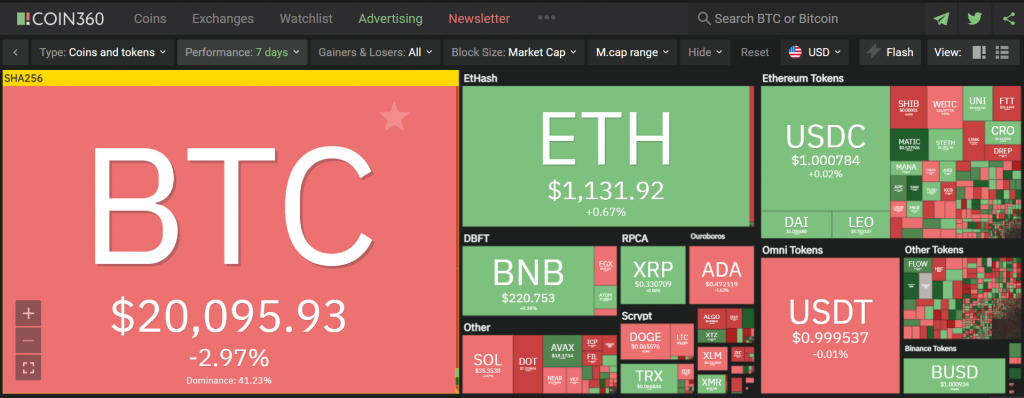

The attached overview from Coin360 illustrates the development of the crypto market over the past seven days. The total crypto market cap currently stands at $902 billion which is fractionally lower than last week.

Bitcoin’s market dominance remained stable around 42.5%. Bitcoin’s market cap decreased slightly to $383 billion. The market dominance of Ethereum (ETH) remained well down at 15%, while the market cap of the number 2 coin did recover slightly in the process to $137.3 billion.

The crypto market has fallen back significantly in recent months and in the process has even reduced the total market cap to below $1,000 billion. This represents a tightening of the 1-year low. So we have to go back to the beginning of last year to see this level on the board.

Total Value Locked in Defi also at 1-year low

The shake out in the Defi sector has resulted in the Total Value Locked (TVL) also falling sharply to a level of $39 billion while in November last year over $106 billion was still ‘locked up’ in crypto lending platforms and other platforms offering (high) yields, among others.

Recently, the decline was accelerated by the loss of Terra Luna due to the UST debacle and, more recently, the crash of Celsius added to it. The price of Celsius has dropped towards the freezing point.

Goldman Sachs smells blood or rather opportunities in the crypto market and intends to take over assets of crypto lender Celsius for a whopping $2 billion. Previously, Banksters of Wallstreet turned up their noses at anything that smells of crypto.

The move by “Goldmine Sachs” indicates the opposite: more and more institutional and professional parties are diving into the crypto market. And that makes the current distressed crypto market even more interesting.

Geef een reactie

Je moet inloggen om een reactie te kunnen plaatsen.